kentucky inheritance tax calculator

Pay within 18 months of the date of the decdents death to pay on time. How much you pay in federal income taxes depends on the information.

What S The Difference Between An Estate Tax And An Inheritance Tax Phelps Laclair

Kentucky estate tax is equal to the amount by which the credits for state death taxes allowable under the federal tax law exceeds the inheritance tax less the discount if taken by the.

. Pay within nine months of the date of the decdents death to receive a 5 discount. Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

Aunts uncles nephews nieces great-grandchildren. In Kentuckys tax system everyone pays an equal tax on. Exempt up to 1000.

Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6. The closer the relationship. Kentucky estate tax is equal to the amount by which the credits for state death taxes allowable under the federal tax law exceeds the inheritance tax less the discount if taken by the.

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Their federal estate tax exemption is no. If you owe more than.

Your household income location filing status and number of personal. When you choose Community Tax you gain access to our intelligent Kentucky tax calculator. The higher the amount the higher the tax rate.

Cousins friends organizations and anyone. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Your average tax rate is 1198 and your marginal tax rate is 22.

The Kentucky inheritance tax is a tax on the right to receive property upon the. Calculate if the estate is too small. For a detailed chart see the inheritance tax table in the.

A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. Kentuckys flat tax rate application is a bit different than the federal income tax which is also considered a progressive tax system. You can use a Kentucky tax calculator to calculate your state tax refund.

An inheritance tax is a tax that is imposed on the value of the assets transferred to an heir based on the relationship of the inheritor and the deceased. This marginal tax rate means that. Rates range from 4 to 16.

Up to 25 cash back The exact tax rate depends on the amount inherited. Kentucky is a reasonably friendly tax state. The inheritance tax is not the same as the estate tax.

If your salary is over 200000 your earnings in excess of 200000 are subject to an additional 09 in Medicare tax. The kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a kentucky estate.

Is There A Federal Inheritance Tax Legalzoom

How To File The Inventory Tax Credit Department Of Revenue

Kentucky Income Tax Calculator Smartasset

2018 2022 Ky Dor Inheritance Estate Tax Forms Instr Fill Online Printable Fillable Blank Pdffiller

How Much Is Inheritance Tax Probate Advance

What Is The Difference Between An Inheritance Tax And An Estate Tax

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

States With Inheritance Tax Or Estate Tax Bookkeepers Com

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

Inheritance Tax 2022 Casaplorer

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

Kentucky Income Tax Calculator 2022 2023

Death Taxes Definition Limits Calculation Pros Cons How To Avoid It

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

California Estate Tax Everything You Need To Know Smartasset

Exploring The Estate Tax Part 1 Journal Of Accountancy

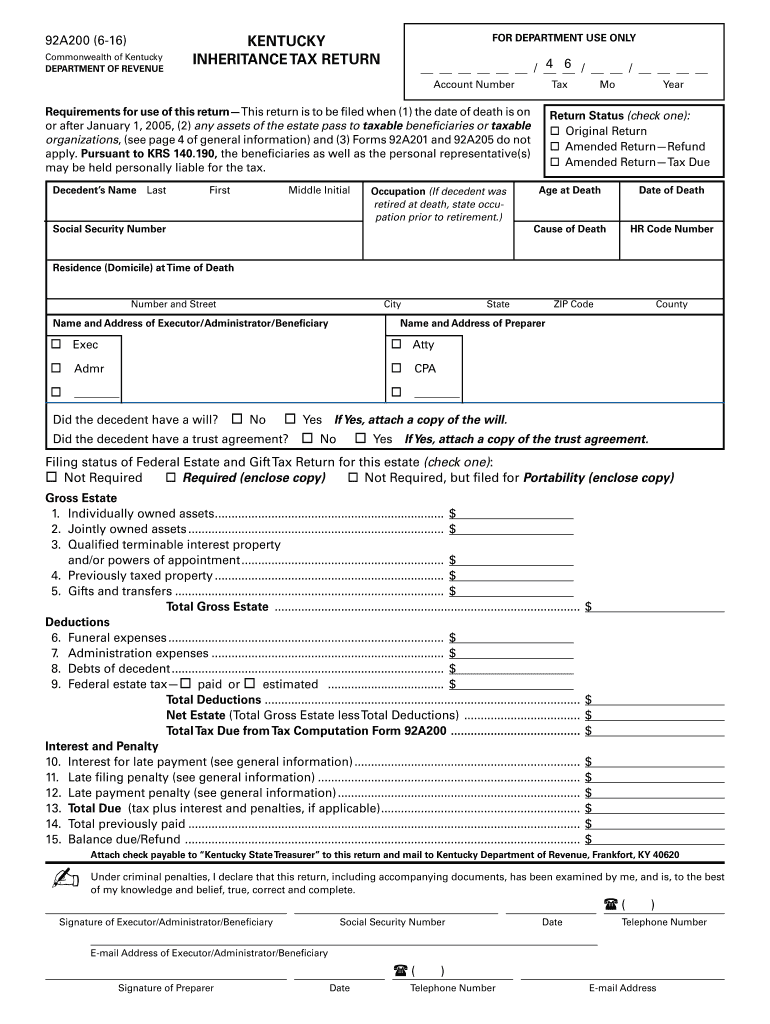

Form 92a200 Fill Out Sign Online Dochub

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return